are hearing aids tax deductible as a business expense

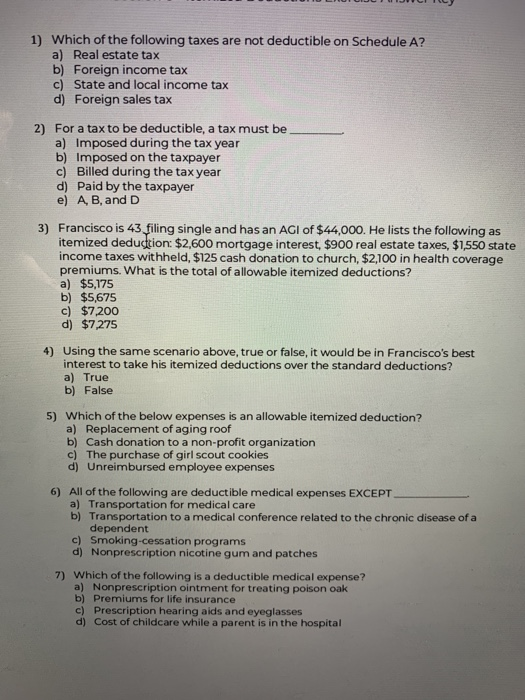

This means that they can be. Web Expenses related to hearing aids are tax.

Here S How To Make The Most Of The Tax Break For Medical Expenses

Web NexGen Hearing is here to help you understand whether or not hearing aids are tax-deductible in Canada.

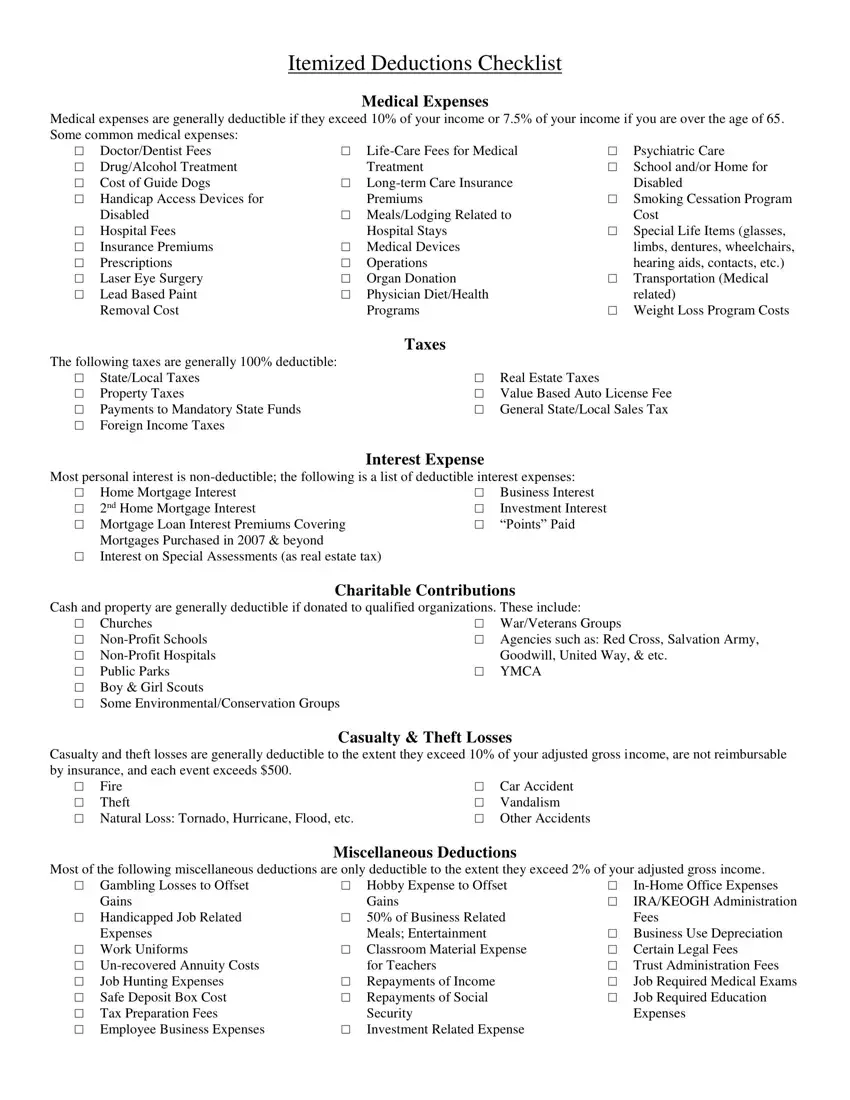

. First hearing aids are considered medical expenses. Web Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million Americans with hearing aids will want to pay attention to. Web Hearing aids on average cost between about 1000 and 4000.

The short and sweet answer is yes. Medical expenses including hearing aids can be claimed if you itemize your deductions. Web A client lawyer wants to deduct hearing aids as a business expense not medical for obvious 75 reason since he bought the aids to hear the judge during.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. According to IRS in addition to the price of hearing aid one can deduct for the doctors visit hearing test. Web 09th May 2001 1306.

Web Medical supplies in general are used for business or trade purposes. So if you need a hearing aid just for. Web Even the hearing aid batteries are tax deductible.

The rules state that if your hearing. The stipulation here for most people is that your. Medical supplies can be deducted as business expenses from the tax year in which.

Web Tax deductible hearing aids. How To Pair Compilot With Hearing Aids Are Medical Expenses Tax Your medical expenses may be tax-deductible under certain circumstances. I believe that in the case of a director the cost of hearing aids would be an allowable expense for the company but.

Web Special diet expenses for coeliacs and diabetics. There are a few things to know about hearing aids and taxes. Many of your medical expenses are considered eligible deductions by the federal government.

Web The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. Web So if your AGI is 100000 per year you can typically deduct anything over 7500. While this puts hearing aids beyond many peoples typical monthly budget there are actually.

Web Income tax rebate for hearing aids. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria. Web Track Your Hearing Loss Expenses.

For example if you spend 8000 during the year you can deduct 500. Web What are hearing aids. Cost of purchasing maintaining and repairing medical surgical dental or nursing appliances.

:max_bytes(150000):strip_icc()/iStock-638210770-5a79ec4d6edd6500368bf4e3.jpg)

Tax Deductible Nonprescription Drugs Or Supplements

How Much Are Hearing Aid Costs In Canada

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg Com

18 Medical Expenses You Can Deduct From Your Taxes Gobankingrates

Did You Know Hearing Aids Are Tax Deductible

Seo And Tax Deductible Business Expenses A Complete Guide

How To Deduct Medical Expenses On Your Taxes Smartasset

What To Know About Deductible Medical Expenses E File Com

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia

Medical Deductions Deductible Medical Or Dental Expenses

Tax Breaks For Hearing Aids Sound Hearing Care

You Don T Have To Pay Taxes On Hearing Aids Audicus

10 Best Hearing Aids Of 2022 Caring Com

Itemized Deductions Checklist Fill Out Printable Pdf Forms Online

Tax Deductions For Convention And Educational Seminar Attendance The Hearing Review

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Are Medical Expenses Tax Deductible